Revenue Forecasting

Treasury & liquidity forecasting

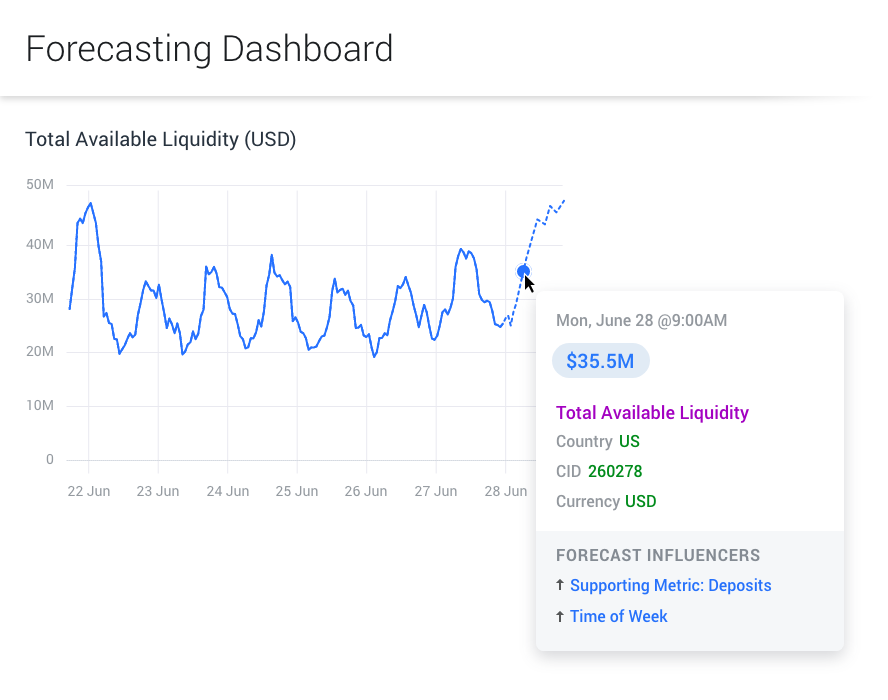

Anodot helps treasurers easily forecast growth or demand and identify liquidity threats to take appropriate action in real time.

Improve your cash flow and risk decision-making

Anodot helps you anticipate what’s coming with the highest possible accuracy. Forecast growth or demand for topline treasury metrics such as:

Balances

Payouts

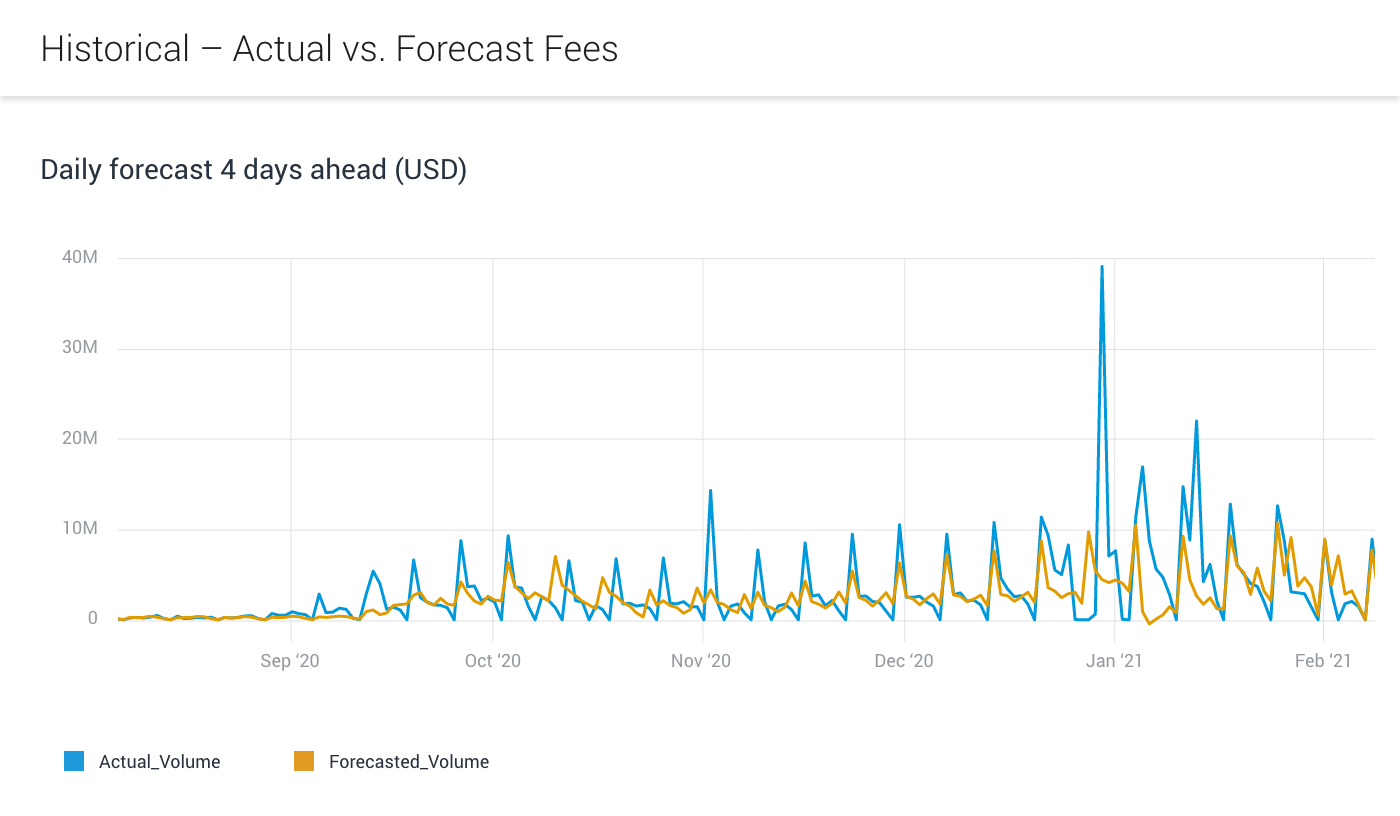

Fees

Positions

Settlements

FX

Are you able to forecast topline treasury KPIs for true liquidity control?

Financial services organizations must forecast, identify and manage liquidity risks in multiple currencies to meet their financial obligations, deliver complete reliability, maximize returns — and maintain a competitive edge. True liquidity control is achieved when an organization can monitor in real-time its actual account activity, compare it against forecasted activity, and manage any discrepancies and risks that arise. Many companies, however, struggle to achieve true liquidity control due to complex, dynamic and siloed data, data delay, lack of granularity and unreliable forecasts.

AI/ML-based autonomous solutions provide highly accurate, real-time liquidity forecasting, helping financial organizations safeguard business continuity and solvency, improve cash utilization, and leverage more value out of their treasury operations. An ML-based forecasting system has many benefits, the most important of which is forecast accuracy — at scale. Forecast models are persistent, so that they can be used continuously or repeatedly on demand. Treasury departments use Anodot’s autonomous forecasting to capture, control and optimize their cash, collateral, and liquidity positions in real-time.

Connect your data and go

You no longer need data scientists to forecast treasury metrics. Anodot automatically manages the machine learning required to create, train, tune and deploy a forecasting model. Getting started is simple: use any of our fast and simple data integration methods to connect your treasury data, select your metrics, and get forecasting.

Accurate forecasts you can trust

Anodot autonomously optimizes liquidity forecasts for accuracy using advanced deep learning. It selects a model that’s uniquely suited to your specific treasury metrics from a library of proprietary predictive analytics algorithms. Data feedback is used to train your model for the highest possible accuracy.

Always on liquidity forecasting

Anodot analyzes your treasury data in real time to provide accurate liquidity forecasts in the moment. With Anodot forecasting, you can anticipate changing conditions and proactively optimize your cash, collateral, and liquidity positions in real-time.

Take your business forecasting to the next level

Continuous forecasting

Highly accurate

Fully autonomous

Fully autonomous

Trading Monitoring