Smooth payment operations are critical for every merchant’s success. At its most basic level, a seamless and reliable payment process is the key to assuring transaction completion, which is at the very core of a merchant’s financial strength.

However, when payment data systems fail to deliver insights about issues regarding approvals, checkouts, fees or fraud, the result is revenue loss and sometimes customer churn.

While there are technology solutions that can process millions of transactions daily, there are many challenges to effective payment monitoring, leaving timely identification and speedy resolutions too often out of reach.

Payment monitoring challenges

There are many challenges to accurate and timely payment monitoring. Among the most formidable are the increasing complexity of the payment ecosystem, the unreliability of static thresholds, the growing success rates of fraud attempts, and manual analysis processes that are too slow for assuring timely resolutions. Let’s take a closer look.

The increasingly complex payments ecosystem

Today’s payments landscape is comprised of many different systems, technologies, methods, and players. There are credit and debit cards, prepaid cards, digital wallets, virtual accounts, mobile wallets and mobile banking, and more.

To complicate matters, many organizations that process payments rely on multiple third-party payment providers, who are sometimes their direct competitors.

There is an additional challenge for companies offering a localized experience to customers. Using local payment systems sometimes means relying on unstable payment networks and represents a measurable risk to the integrity of payment processes.

This broad and ever-growing ecosystem can be confusing and difficult for merchants and payment services providers to orchestrate, especially when it comes to determining the optimal path for monitoring, detecting, and remediating issues with the payment process.

Static thresholds

Merchants today typically either monitor transactions manually or receive alerts on payment issues based on static thresholds whose definitions are driven by historical data. But user behavior patterns are dynamic, which means that static, historically driven settings and definitions are not reliable for detecting (and handling) issues in real time.

This frequently results in missing incidents or discovering incidents too late after the damage has been done.

The increasing success rates of payments fraud attempts

The global ecommerce industry is poised to grow into a $5.4 trillion market by 2026 and with it – online and digital payment fraud is also growing exponentially.

Fraudster techniques have become increasingly more sophisticated and their success rates are higher than ever. Last year, $155 billion in online sales were lost to fraud, and this number is expected to continue to grow.

And according to the recent AFP Payments Fraud and Control Report, 75% of large companies with annual revenue at over $1 billion were hit by payment fraud in the past year, and 66% of mid-size companies with annual revenues at under $1 billion.

Manual analysis

Even when a payment incident is detected, understanding the root cause for accelerating remediation can still be very challenging.

Whether at merchants or financial services organizations, those who are charged with understanding the root cause of payment issues and remediating them are typically faced with having to manually scour through multiple dashboards.

This approach which is very time intensive is no longer viable. Decisions need to be made in real time and actions must be taken immediately. A delay in mitigation is not something any organization can afford, as it drives revenue loss.

Rules based routing

Many merchants and payment services companies route payments as driven by simple rules engines. However, this approach is not designed to address today’s needs for fast, efficient, and smart routing.

To overcome all of these challenges, what these organizations and every merchant needs is a way to detect payment issues faster and get alerts in real time when there are revenue-critical incidents in their payment operations.

This is where AI-powered payment monitoring comes in.

AI takes payment monitoring to a whole new level

When we introduce AI-powered analytics and real-time monitoring to the task, merchants are finally empowered to overcome the above-mentioned challenges and prevent revenue loss.

They can monitor all of their payment data and capture continuous insights into their payment lifecycles. They can know instantly upon the appearance of a suspicious trend or when payments fail and receive real-time alerts that provide the full context of what is happening, including incident impact, timeline, and correlations. Additional benefits include:

Faster root cause detection

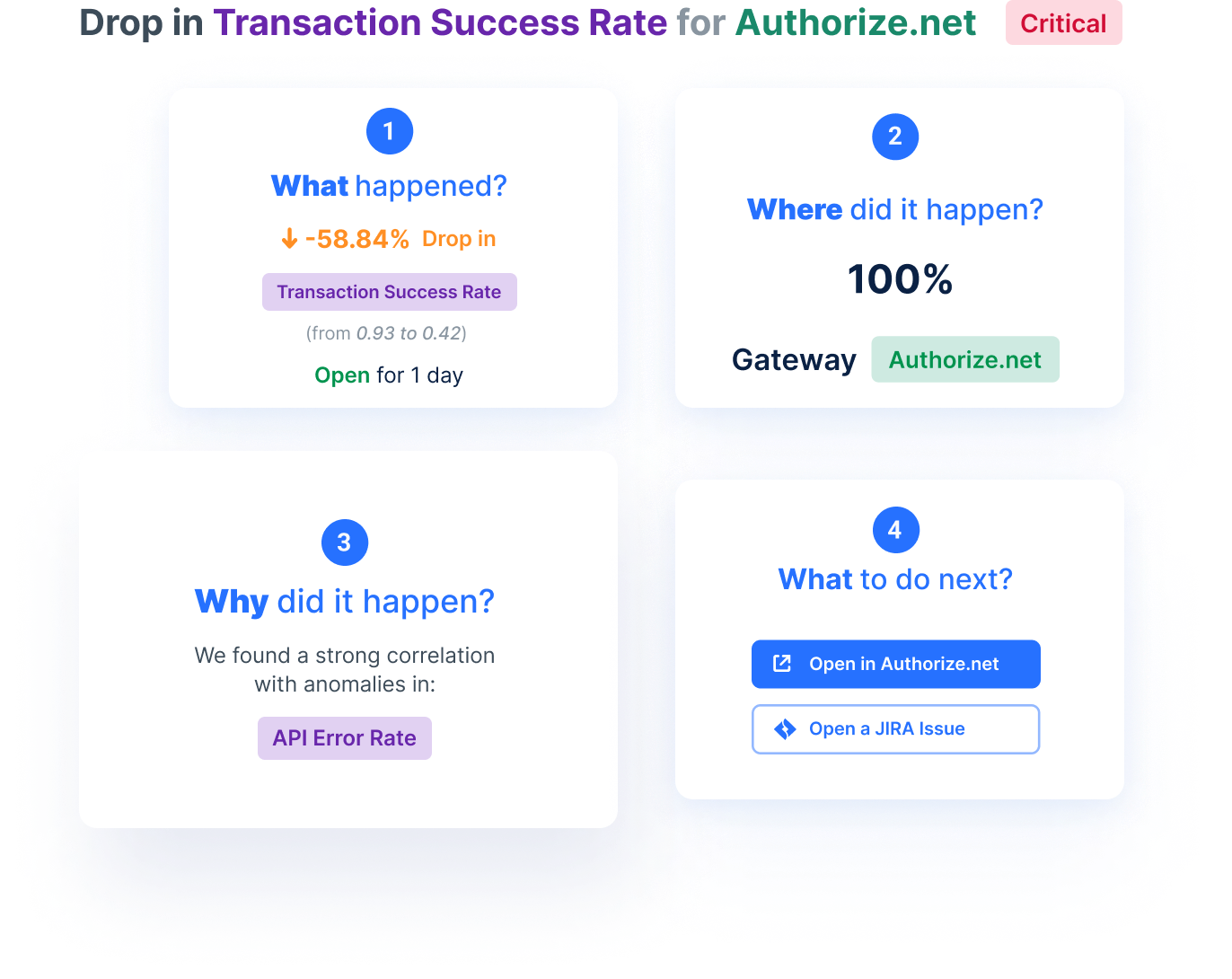

AI-driven payment monitoring learns the normal behavior of all business metrics, constantly monitoring every step in the payment lifecycle, and providing crucial workflow insights.

This happens automatically, where merchants and payment service providers get much-needed visibility into what happened, where it happened, why it happened, and what they should do next, for faster than ever time root cause detection.

Real-time actions

When payment monitoring is driven by AI, monitoring and alerting is real-time, empowering organizations to detect and act upon any deviation from normal transaction behavior.

This way they can capture incidents before they impact the customer experience.

Noise alert reduction

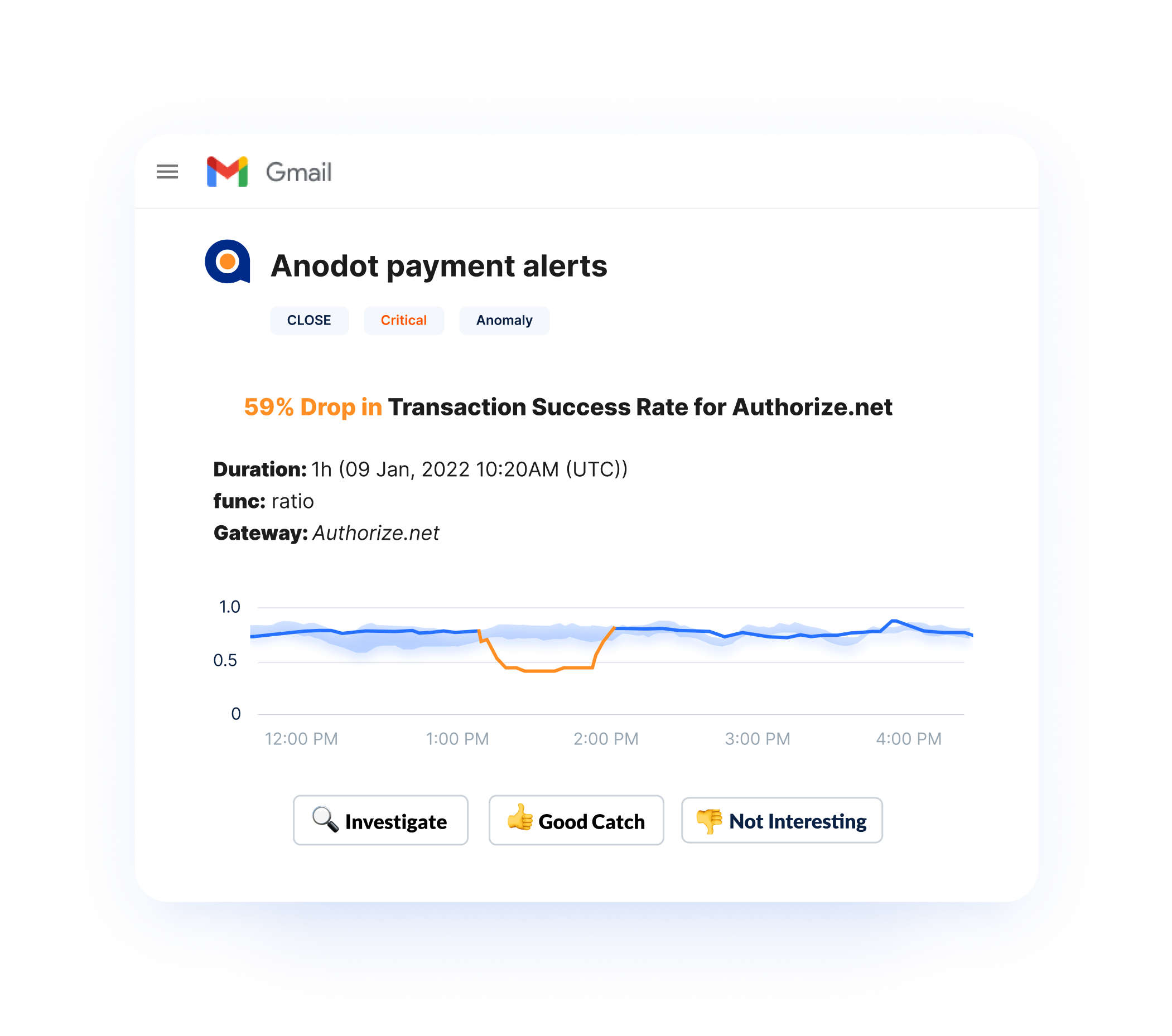

By learning what impacts customers and the business and what doesn’t, billions of data events can be distilled into a single, scored, highly accurate alert.

This makes storms, false positives, and false negatives a thing of the past, and enables teams to focus on the incidents that bring a measurable impact to revenues and the customer experience.

Moreover, users will no longer need to subscribe to alerts, which often wind up in the ‘graveyard of alerts’ folder, with no measurable value for the payments operation.

Accelerated time to remediation

When needed insights can be gathered automatically at the right time, there is no need to sift through endless graphs on multiple dashboards.

AI enables the correlation of anomalies for immediately identifying the contributing factors to incidents, and receiving the full context required for expediting the right remediation actions.

How Anodot can help

Anodot brings an AI-powered solution for autonomously monitoring the volume and value of a merchant’s payment data, including transaction counts, payment amounts, fees, and more.

The solution detects payment incidents 80% faster and profoundly accelerates resolutions, sending immediate alerts when there are transaction or merchant issues, and payment or approval failures.

Notifications are seamlessly integrated into existing workflows, with only the most important issues being surfaced to prevent time being wasted on false positives, and profoundly reducing alert noise by 90%.

Anodot’s patented correlation technology helps to identify the root cause of issues with 50% faster root cause analysis.

The out-of-the-box solution comes with turnkey integrations, and is pre-configured with impactful payment metrics and dimensions. This way, organizations can accelerate ROI and time to value.