In a recent article published by Economic Times on Dec 29, 2023, titled “Banks Told to Explore Dashboard with Real-Time Info on Services,” the Reserve Bank of India (RBI) has urged banks to embrace real-time transparency through the creation of an online dashboard. Anodot, a leader in business monitoring, is at the forefront of transforming the banking sector with its advanced real-time business monitoring dashboard designed for internal usage within banks.

What does this mean? It means it’s high time for banks to embrace the significance of real-time actions, and dashboards (like Anodot) can be here to lend a hand.

Why Anodot’s Real-Time Monitoring is the Best for Banking Excellence

As banks grapple with technical glitches causing service disruptions, Anodot offers a robust solution—an advanced real-time monitoring dashboard designed for internal use. This dashboard empowers banks to proactively identify issues that could affect security, revenue, or customer experience, ensuring a seamless and secure banking environment.

Immediate Benefits for Banks with Anodot features

Anodot’s real-time monitoring dashboard provides banks with unparalleled capabilities to:

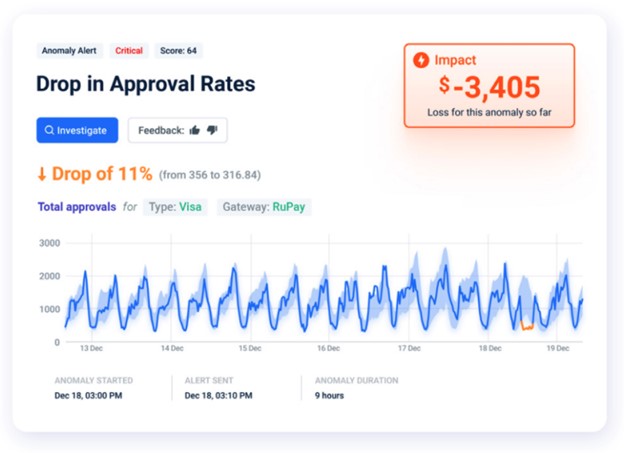

- Optimize Revenue Streams: Immediately Identify anomalies impacting revenue streams, allowing swift corrective action to be taken.

- Enhance Security: Detect potential security threats in real-time, safeguarding sensitive information and customer data.

- Improve Customer Experience: Proactively address issues that could impact customer experience, ensuring satisfaction and loyalty.

Banks, facing penalties for service disruptions now have an opportunity to elevate their monitoring capabilities with Anodot’s solution. By integrating Anodot’s real-time dashboard into their operations, banks can move beyond reactive measures and adopt a proactive stance, identifying and resolving issues before they escalate.

Insights for Retail Investors

For investors in bank stocks, Anodot’s real-time dashboard underscores the importance of technology in mitigating risks. It highlights the potential for banks to invest in advanced business monitoring solutions, enhancing their resilience and market standing.

Impact on Industries: Opportunities with Anodot

Anodot’s real-time monitoring dashboard has far-reaching effects on various industries:

- Fintech Software: Integrating Anodot’s solution becomes pivotal for offering robust and secure financial services.

- IT Services & Infrastructure: Anodot’s advanced monitoring drives demand for modernization and proactive issue resolution.

- Telecom: Ensuring connectivity for seamless banking services gains prominence with Anodot’s real-time insights.

- AdTech and Gaming: Anodot’s success in AdTech and Gaming showcases the adaptability of its monitoring solutions, providing insights and trust in dynamic and high-transaction-volume environments.

Anodot’s Exceptional Pedigree in Real-time Monitoring Excellence

Long-Term Structural Improvements

Anodot has over ten years of experience providing real-time monitoring that can lead to valuable insights.

- Resilient Infrastructure: Banks undergo a structural overhaul, enhancing their technology foundations for peak capacity, security, and process complexity.

- Responsible Innovation: The rollout of new features prioritizes stability, aligning innovation with execution capability.

- Level Playing Field: Uniform visibility enables objective comparisons, preventing weak IT budgets from hiding behind marketing claims.

- Business Continuity: Standardized redundancies, instant failovers, and geographic contingencies minimize the impact of outages.

- Trust Building: Reliable functionality establishes credibility, driving financial inclusion and a more inclusive banking experience.

However, balancing transparency responsibly is crucial to avoid trivializing customer complaints without appreciating the scale of difficulties involved.

Short-Term Positives: Immediate Benefits and Scrutiny with Anodot

In the short term, Anodot’s real-time monitoring dashboard offers:

- Granular Insights: Instant visibility enables proactive issue resolution, ensuring a secure and seamless banking experience.

- Optimized Operations: Swift corrective actions based on Anodot’s insights result in revenue optimization and enhanced customer satisfaction.

- Vendor Accountability: Clear visibility into recurring issues allows banks to hold third-party vendors accountable, ensuring robust partnerships.

- Leadership Motivation: Public metrics serve as a performance indicator, motivating urgency in stabilizing systems.

The extent of progress depends on the successful integration of Anodot’s real-time dashboard across banks and effective communication within the industry.

Companies Impacted with Anodot

The adoption of Anodot’s real-time monitoring dashboard has different implications for various companies, including

Companies Gaining with Anodot:

- Fintech Companies with Real-time Data Analytics Solutions powered by Anodot

- Digital Payment Infrastructure Providers benefitting from Anodot’s reliability insights

- Banks with Robust Digital Infrastructure leveraging Anodot’s predictive analytics

- IT Consulting and System Integration Firms with expertise in Anodot-powered solutions

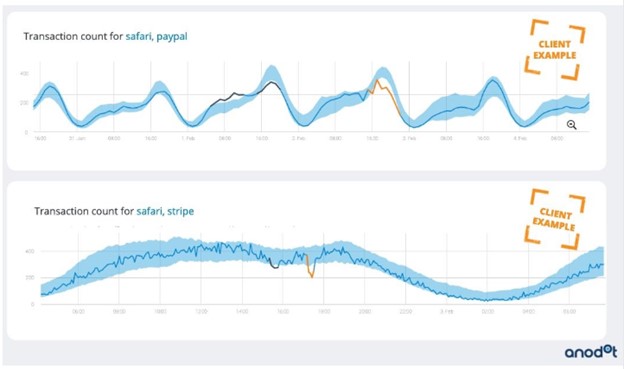

Anodot collects and analyzes data across the entire payment stack and ecosystem. All metrics are monitored at scale, enabling operators to achieve complete visibility over the payments environment. Anodot’s patented correlation engine correlates anomalies across the business for holistic root cause analysis and the fastest time to resolution, leading to significantly improved approval rate, performance, availability, and customer experience.

Banking Excellence is Possible with Anodot as a Partner

As the Economic Times highlights the RBI’s push for real-time transparency, Anodot is here to equip banks with advanced monitoring capabilities. With its powerful dashboard, Anodot is a game-changer for banks looking to thrive in the digital age by boosting revenue, enhancing security, and improving customer experience. And it’s not just limited to banking—Anodot’s adaptability spans industries like fintech and telecom, backed by a decade of specialized experience. By integrating these real-time insights, banks protect their operations and foster trust and loyalty among customers, gaining a competitive edge. The message is crystal clear: embracing proactive, real-time monitoring with Anodot isn’t just about avoiding penalties or disruptions—it’s about seizing an opportunity for transformation and delivering excellent service.

Discover how Anodot can enhance your financial business with flawless customer experience, payment optimization, and operational excellence. Let’s talk.