In todays’ digital world, a seamless payment process is critical for maximizing a company’s potential revenue. Payment gateways, the technology that captures and transfers payment data from customers to merchants, play a key role in keeping the payment ecosystem running smoothly.

Payment gateway analytics

In the complex payment environment, payment companies face the constant challenge of optimizing transaction rates, reducing payment declines, and the involuntary churn these issues create.

Payment gateway analytics provide much-needed visibility across the payment process journey to enable the fast detection of transaction performance issues, anomalies, or trends. When used efficiently, the technology can benefit businesses by providing insight into revenue, payment trends, and customer behavior.

On top of monitoring conversion rates and customer information, payment gateway analytics can help track gateway approval rates for intelligent routing decisions. The insight also helps ensure maximum payment success by enabling route transactions to the best provider.

When combined with advanced ML-based monitoring and automation, payment gateway analytics leverages historical as well as real-time data to enable users to make the most informed decisions about which payment gateways to use.

Automated payment monitoring solutions can collect and analyze data from multiple sources to determine which payment gateways have the highest transaction rates by payment method, location, device, etc. These insights can help merchants efficiently process payments, increase approval rates, and boost their bottom line.

Gateway analytics and intelligent routing can help payment providers and merchants improve their transaction success rates, but choosing the right payment gateway is only one variable in the complex and interconnected payments process. While payment analytics refers to integrating and processing payments data from various sources like cards, mobile wallets, and bank transfers, if used efficiently it can benefit businesses by providing insights into their revenue, payment trends, and customer shopping behavior. It is therefore critical that operations teams focus on implementing AI-based monitoring strategies that offer holistic approaches to payments optimization.

Autonomous payment gateway monitoring

Time is critical for payment companies and mistakes can cost millions in revenue and lost customers. With transaction volumes continuing to explode, fintech operations teams can’t afford any processing errors. A lack of comprehensive business-level visibility and control results in longer mean time to recovery (MTTR) for customer experience and a variety of revenue-related issues — all of which can lead to greater customer churn, bad press, and damaged brand reputation.

Anodot’s Autonomous Business Monitoring platform helps fintechs stay on top of their operations with full coverage monitoring that delivers the fastest time to accurate detection. Anodot autonomously distills billions of payment data events into single spot-on alerts. Alerting in real-time cuts time to detection, enabling proactive incident management by payment operations teams.

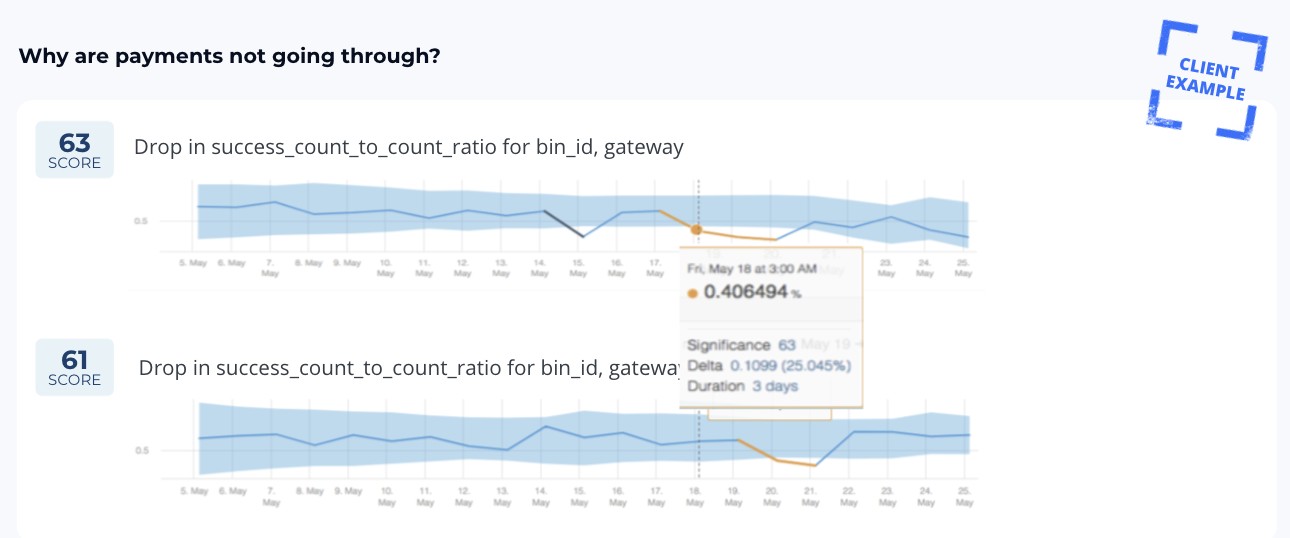

In this example, Anodot detected an unusually low amount of successful payments for a payment provider. Alerts sent to the operations team was critical to fixing the issue and preventing additional payment declines and customer churn.

Anodot collects and analyzes data across the entire payment stack and ecosystem. All metrics are actively monitored, at scale, enabling operators to achieve full visibility over the payments environment. Anodot’s patented correlation engine correlates anomalies across the business for holistic root cause analysis and the fastest time to resolution, leading to significantly improved approval rate, performance, availability, and customer experience.

Anodot is completely autonomous. There’s no need to define what data to look for or when no manual thresholds to set up or update. Anodot is built for business and operations users, so no data science is required to derive value from the system. Fintech companies using Anodot’s autonomous monitoring solution report 80% faster detection time, 90% drop in alert noise, and 30% reduction in incident costs.

The fintech space is continuing to evolve. Whether you’re a retailer, acquirer, or payments processor, it’s crucial to have complete visibility into your payments ecosystem. Talk to us to learn more about how Anodot can help your financial business deliver flawless customer experience, payment optimization and operational excellence.