The total transaction value of digital payments is projected to exceed $1.7 billion by the end of 2022. Each one of these transactions generates masses of data that contains critical insights for merchants, payment service providers, acquirers, fintechs, and other stakeholders in the payments ecosystem.

Having real-time access to these insights has the power to drive growth through customer and market understanding. It also has the power to protect against tremendous revenue loss by mitigating the risk of payment issues and fraud.

The payments data mandate

Real-time payment monitoring and detection of transaction incidents is one of payment data’s most important mandates.

Whether there’s an increase in payment failures, a drop in approval rates, or other issues — operations, payments, and risk managers must be able to see what went wrong, where, and why.

This is the only way they can accelerate root cause analysis and quickly triage and resolve payment incidents.

But gaining complete visibility into the payments ecosystem in real time in order to detect anomalies immediately is a great challenge, though one that no organization can afford to ignore.

Time could not be more of the essence. Consider what happens if there is a glitch in an API to a backend payment system that is crucial for approvals. If transactions can’t access the relevant API, the payment acceptance rate will plummet and revenue will be lost during the unexpected downtime.

So, while organizations are collecting large volumes of data every day, if the data can’t be used to protect the organization against payment incidents and potential loss, the value of the data will never be realized and losses will continue to impact business health.

Challenges of optimizing payments data

The bridge between collecting payment data and using it effectively is full of obstacles, which primarily fall into three categories – access, process and infrastructure, and complexity.

Access to user data

- User onboarding: Aggregating user data is complicated by the fact that assuring a good user onboarding and registration experience typically requires asking as few questions as possible (to avoid abandonment due to complicated and time-consuming processes).

- Owning the relationship: Most payments stakeholders don’t necessarily own the end user relationship. This means they don’t have access to the relevant user data, making it all the more difficult to detect which user activities are anomalous.

- Tokenization: Access to user data is also hindered when using external tokenization, which keeps most of the user and card information with the tokenizer rather than with the merchant or payments service provider.

- Data privacy: Detecting anomalous behaviors requires aggregating data about user behavior. However, data privacy regulations and regulators limit the usage of personal user information.

- Equal access: Even when the right user data is being collected by the organization, not all departments have equal access to it, nor is it shared sufficiently and frequently enough by those who do have access.

Process & infrastructure related

- Processes are manual resulting in monitoring and detection that are slow and error-prone with real-time outcomes being impossible to achieve.

- Real-time collection and analysis for timely decision making is impractical due to the complexity involved with the implementation and application of the numerous APIs required for collection.

- Intelligent insights provided in real time are typically out of reach since no one-size-fits-all solution can address the variety of incidents that occur during the specific recovery and handling processes of each organization.

Complexity

- The payment ecosystem is continually growing with more systems and data sources than ever, making it very difficult to collect and connect relevant payments data.

- Sources and data formats are fragmented, also making the task of aggregating data into one coherent source of truth a difficult task.

- Different payment methods and flows carry different data sets impacting the ability to unify operational data.

- Not all data is being collected via APIs leaving a lot of gaps since not all the data can be gathered.

Getting the most out of payments data

The goal of overcoming these challenges is to be able to get the most out of payments data. In order to optimize payment operations, teams should be able to:

- Leverage data for actionable insights specifically into user activity in order to detect anomalous behaviors.

- Access all relevant user data, which is enabled by integrations that entail implementing every relevant API, not only those which are related to payments instructions.

- Gain a fuller picture of user behaviors for better understanding what is anomalous, which is enabled by embedding external data sources into the existing data management environment.

- Analyze data to build forecasts regarding activity, money flow, user behaviors, seasonality, and more, and not only for understanding what has happened, which drives a better understanding of potential risk.

- Make intelligence-driven decisions and remove the burden of manual work from payments personnel, which is enabled by AI and machine learning.

- Better understand the scope and patterns of user behaviors and payments trends, which is enabled by analyzing data across multiple time periods and granularities.

Anodot for payment intelligence

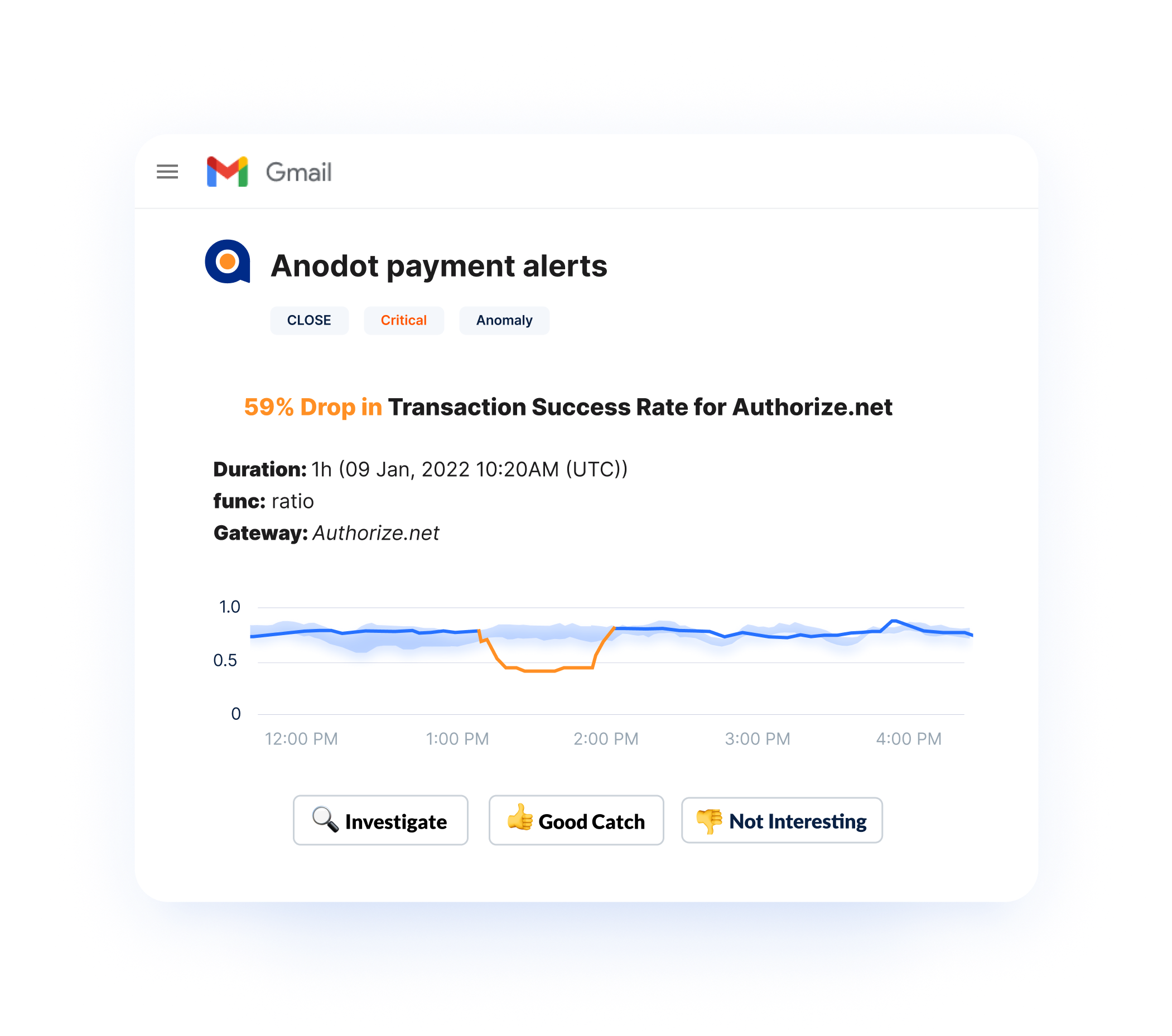

Anodot for payment monitoring and real-time incident detection overcomes the challenges to payment operations, incident detection and remediation.

Anodot’s AI-powered solution autonomously monitors the volume and value of payment data, including transaction counts, payment amounts, fees, and much more.

The solution delivers immediate alerts when there are payment approval failures, transaction incidents and merchant issues. Our patented correlation technology helps to identify the root cause of issues for accelerating time to remediation.

Anodot automates payment operations, seamlessly integrating notifications into your organization’s workflow. And by filtering through alert noise and false positives to surface the most important issues, it minimizes the impact on revenue and merchants.

Turnkey integrations aggregate data sources into one centralized analytics platform. With impactful payment metrics and dimensions pre-configured into the solution, anyone in the organization can leverage data for insights and actions.