AI-driven business monitoring could have prevented expensive glitch for Santander Bank

As most people were preparing to celebrate the new year, the UK’s Santander Bank was dealing with a crisis. On Christmas day, roughly 75,000 people who received payments from companies with accounts at Santander Bank received a duplicate payment transaction.

The total damage amounted to £130m, and recovery in these situations is a painful process for both the bank and its customers. Making things even more complicated is that many of those who received the erroneous funds are customers of different banks. It’s a big mess, but could it have been prevented?

Preventing revenue critical incidents with AI analytics

The right monitoring approach could have prevented or at the very least mitigated the incident at Santander Bank. It appears that most of the transactions happened in a short time, on the same day and perhaps in the same hour. Even if the bank was monitoring this type of use case, manual processes and traditional monitoring don’t cope well when disasters quickly progress. AI models are far more adept at catching anomalies in real-time and alerting intervention teams before the damage gets out of hand.

To respond to costly anomalies in real-time, organizations need systems that thoroughly understand the expected behavior of all components and transactions. Integrating machine learning and AI-empowered monitoring tools can aid this process by establishing a clear baseline of anticipated behavior across any business metric. Things like seasonality, customer behavior, and routine transactions help these monitoring solutions identify anomalies as soon as they occur.

None of this is to say that it’s a simple problem to solve. On the contrary, modern banking systems are incredibly complex, with integrated systems and transactions fragmented into multiple streams and sophisticated interactions with external partners (and competitors). Human observation of traditional dashboards can’t keep up with all this complexity.

How Anodot helps banking and payment companies detect revenue-critical incidents

As the Santander incident demonstrates, glitches within the complex banking and payments ecosystem can lead to a significant incident costing companies millions and eroding customer confidence. In cases like these, timing is everything. AI and Machine Learning empowered monitoring is simply essential to oversee it all and ensure that incident responders receive real-time alerts so they can intervene before it’s too late.

Anodot is an AI-driven business monitoring solution that helps companies protect their revenue with a platform that constantly analyzes and correlates every business parameter. It catches revenue and customer impacting anomalies across all segments in real-time, cutting time to detect revenue-critical issues by as much as 80 percent.

Anodot helps global banks immediately identify issues such as failed and declined transaction rates, login attempts, device usage and the transaction amount per type – all of which are valuable in detecting potential revenue and customer experience issues.

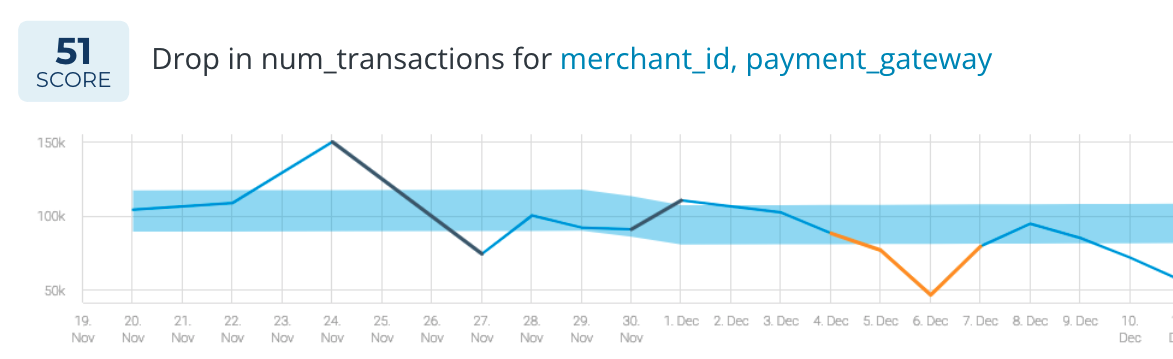

For example, Anodot can immediately identify an unusual drop in transactions, which could mean a potential issue with a bank card or payment gateway. Real-time alerts ensure the issues can be resolved before impacting customers or revenue.

Real-time financial protection for the world’s most complex businesses

Anodot’s AI models provide proactive protection by catching potential issues immediately. It doesn’t matter how complex the system is or how diverse the customer base might be. Problems are remediated quickly before minor nuisances turn into massive incidents.

With Anodot, integrations are simple

Managing financial systems is complicated enough. Anodot adds robust, automated monitoring capability with no painful integrations and no learning curve for your operators. Within minutes, Anodot’s built-in connectors learn the expected behavior of every single business metric in a system and start monitoring all streams for abnormal behavior.

Actionable alerts that suit your processes

Not only does Anodot autonomously monitor billions of events for every metric in a company’s revenue streams, but it distills them into singular alerts scored by impact and immediacy. Anodot notifies your teams via existing comms systems like email, Slack, PagerDuty, or even Webhook with minimal false positives.

The rise of digital solutions, payment channels and transaction volumes has caused an exponential surge in the amount of data that must be monitored and managed. Leaders in the financial services and payments industries are using AI-driven technologies to monitor high volumes of data, from multiple sources, in an efficient manner.