As usage-based pricing models have continued to increase over the past decade, particularly for technology companies, there has been a major shift in budget planning and resource allocation. Since CFOs can no longer predict or approve each and every expense before they’re incurred, variations in usage costs can often make or break business profitability.

Two of the most common usage-based costs come from online advertising and IT-related cloud costs. If not monitored correctly, one wrong configuration can lead to serious runaway expenses.

To solve this challenge, companies developed the role of Financial Operations, or FinOps. The FinOps foundation defines the term as an evolving cloud financial management discipline and cultural practice that enables organizations to get maximum business value by helping engineering, finance and business teams collaborate on data-driven spending decisions.

In this guide, we’ll discuss what FinOps is, how AI and machine learning is used to automate this task and obtain more accurate insights, and cover how FinOps is being used for cloud cost management.

What are FinOps Tool?

FinOps tools are third party cloud cost management tools that help you wrangle cloud spend for your company. FinOps tools are the best solutions for understanding your cloud bill since cloud prices are so often shrouded in mystery. These tools will help you justify costs and optimize spend, and make it easier for you to evangelize the importance of the cloud to other areas of your company.

The Three Phases of Adopting FinOps

As you may know, two major challenges in the adoption of FinOps in an organization are talent and technology.

In terms of talent, this emerging field requires financial professionals to have an understanding of diverse fields such as data analytics, AI, and machine learning. This requires not only an investment in upskilling employees, but also requires a cultural shift of diverse departments working together. In particular, the FinOps Foundation describes three iterative phases to adopt this new discipline and optimize variable expenses in real-time, these include:

- Inform: The first phase of adoption involves empowering the organization with “visibility, allocation, benchmarking, budgeting and forecasting.” As mentioned, the on-demand nature of usage-based billing means that the accuracy and visibility associated expenses is crucial for intelligent decision making.

- Optimize: Once organizations and teams have the necessary visibility into their expenses, the next step is optimization. In the case of cloud costs, optimization can come from more accurate forecasting, which allows you to reserve instances for cost-efficiently.

- Operate: The final phase involves continuously monitoring and evaluating how variable expenses are tracking against business objectives. Since these expenses often involve tracking thousands of metrics simultaneously, this is where technology such as AI and machine learning comes into the picture for real-time monitoring.

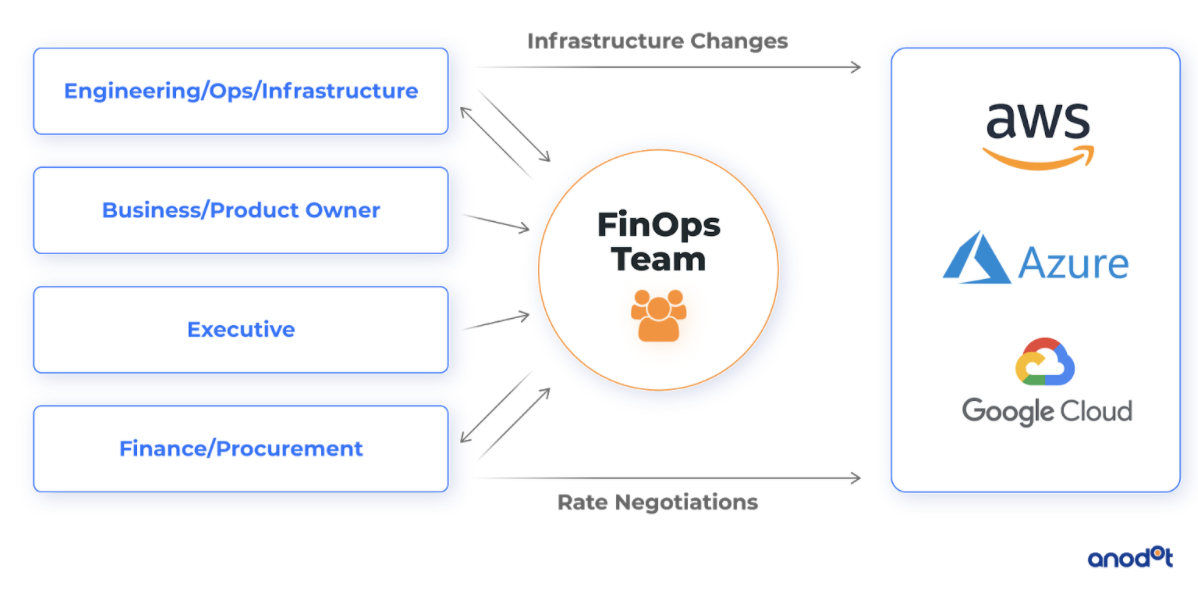

Here is an overview of the team structures that enable FinOps adoption within an organization:

Key Functions and Features of FinOps Tools

A good FinOps tool will help you accomplish the three pillars of FinOps:

- Inform: First and foremost, a good FinOps tool should improve cloud transparency. It should help not only you and your team, but your entire organization, better understand the financial and operational costs of working in the cloud.

- Optimize: Arguably one of the most exciting features of a FinOps tool is its ability to optimize cloud performance and help your company save money. This is accomplished by addressing unnecessary cloud spend, automating basic tasks, and identifying any cloud data inefficiencies.

- Operate: Your FinOps tool should integrate and operate with your pre-existing suite seamlessly. This means you can continue business as usual while your new tool provides constant measurement and tracking to optimize speed, cost, and quality in the background.

Other features you should expect include:

- Clarity on cloud ownership.

- Improved collaboration across organizational pillars.

- Scalability as your FinOps tool should meet you stride for stride.

How To Choose The Right FinOps Tool For Your Needs

Since so many stakeholders are usually involved in the process of choosing a FinOps tool, choosing the best tool for your needs can be difficult. To simplify things, keep the following five features in mind:

- Seamless integration. You want a tool that can easily connect with your cloud provider (ex: AWS, GCP, Azure) so that your cloud functions can operate at maximum potential.

- Fully secure and compliant. Your chosen tool should be fully compliant with general regulations like GDPR and industry-specific rules like HIPAA. Features like compliance auditing ensure that the FinOps tool remains up to date and that your company and your client data are kept secure.

- User-friendly dashboards. A FinOps tool should be intuitive and easy to use. A good tool should include an impressive user experience and dashboards that make reporting a breeze.

- Comprehensive automation. One of the biggest appealing factors of a FinOps tool is its ability to make menial but time-consuming tasks automated. A good FinOps tool means management and budget tracking can be done at the push of a button.

- Full scalability. Your FinOps tool should scale with your company. That might look like following you through a cloud or hybrid cloud migration, or scaling up or down as you require more or less cloud services.

AI & Machine Learning for FinOps

As mentioned, the fact that variable expenses such as cloud costs and advertising expenses are incurred in real time, having the right monitoring technology in place is a necessity to prevent runaway expenses.

One of the main issues with traditional monitoring technologies, however, is that they are largely reactive in nature. In particular, they typically rely on static alert thresholds, dashboards, and reports. Similarly, the tools offered by cloud or advertising providers often have at least a 24 hour delay in the availability of data.

As discussed in our guide to business monitoring, business metrics are not well suited for static monitoring described above for three main reasons:

- Business metrics can’t be evaluated in absolute terms due to the fact that they derive significance from a unique context.

- Compared to machine data in which there is a known relationship between machines, business metrics have an unknown topology. In other words, the relationships and correlations between metrics are simply too dynamic to be known.

- Finally, business metrics often have an irregular sampling where it may be minutes or hours between data, for example between a purchase or a click.

To deal with these unique challenges, AI and machine learning have proven to be well suited for real time monitoring. The inherent complexity of business metrics are handled in the following ways:

- 100% of the data can be monitored in real time with the use of a technique called unsupervised learning

- Each individual metric’s normal behavior is learned autonomously

- Each metric is correlated with the others and paired with a deep root cause analysis

As shown in the example below, the technological advantages of machine learning result in a faster time-to-detection and time-to-resolution. In other words, AI-based monitoring offers FinOps teams the right technology to shift from a reactive to a proactive approach.

Use Case: Machine Learning for FinOps Monitoring

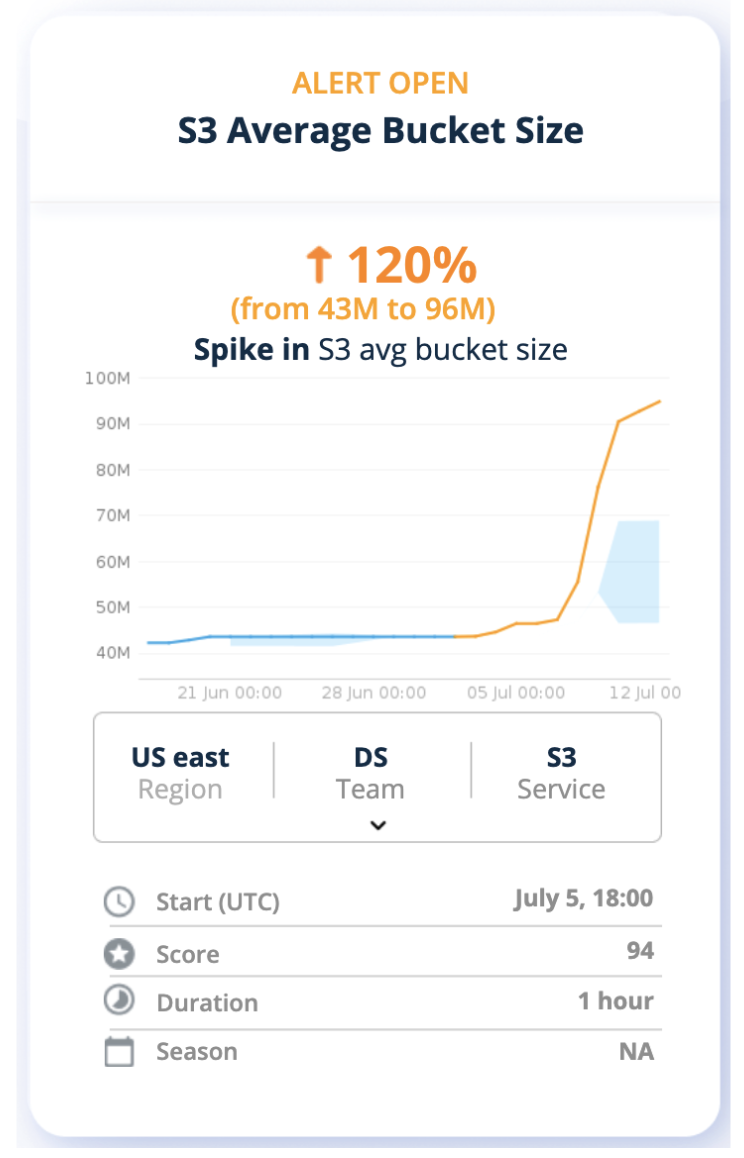

As mentioned, cloud cost monitoring is a good place to start with FinOps since small mistakes can often lead to large and unnecessary expenses. For one company, the average hourly bucket size of an AWS service spiked 120 percent over the course of a week. In this case, the spike was caused by a developer accidentally releasing a script that continuously created new buckets.

This increase in average S3 bucket size was detected by Anodot’s machine learning algorithms, which detected the spike within the first hour. Unfortunately, Anodot’s alert went unnoticed and the issue persisted for more than seven days and caused $10k+ in avoidable expenses.

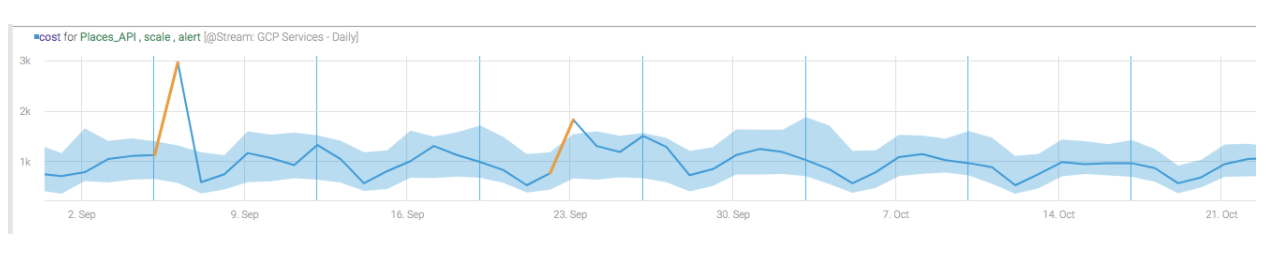

In addition to cloud costs, FinOps monitoring proves useful in tracking cost anomalies across the business. Check out the graph below showing two spikes related to a Google Maps API. In this example, these spikes cost the user $1,685 and $285, respectively.

If this company was not using Anodot, the data delay could have easily gone undetected, costing the company thousands in revenue. From this graph, you can see, however, that these two anomalies were each detected and resolved within an hour.

Top 5 FinOps Tips

While there is no one-size-fits-all approach to FinOps and cloud cost management, there are specific actions practitioners can take to make the most impact. Anodot’s FinOps specialist, Melissa Abecasis, shares her top 5 tips for FinOps success in this video.

The Top 5 FinOps Tips include:

1. Tag Resources

A well-defined cloud tagging policy is the backbone of cloud governance setup and Melissa says it’s never too early to start tagging your resources to enable accurate cost chargeback and showback. When deciding what tags to implement, it’s best to start with a simple list to make it easier to get into the habit of tagging resources. Tags by application, owner, business unit, environment and customer are all commonly tagged resources.

2. Savings Plan Commitments

Melissa suggests that if organizations know they will be using AWS in the next year or so, there is no reason not to take advantage of AWS Compute Savings Plans. The plans allow subscribers to pay lower costs in exchange for committing to use particular AWS services for one to three years. Melissa says commitment savings can be as high as 50%, so even if you have 10% or 20% underutilization of a resource, you’re still achieving significant savings.

3. Private Pricing

AWS provides private pricing for a variety of services. The most common include Cloudfront, Data Transfer and S3. Melissa says you may be eligible if have usage of: more than 10 terabytes for Cloudfront data transfer out, 500 terabytes of interagency data transfer, 500 terabytes of data transfer out or petabyte of S3 per month. If these apply to your organization, Melissa suggests speaking with your AWS account manager about the significant savings you can achieve through private pricing.

4. Don’t Ignore Smaller Costs

An organization’s top 10 cloud services typically account for 70% – 90% of total cloud costs. But Melissa urges FinOps practitioners not to ignore the smaller services. For services that cost $100 to $1,000 a month, it’s still worth gaining visibility into each to determine if there are forgotten backups that are no longer needed or testing environments that are not being used. Those small wins can add up to thousands of dollars a day.

5. Create Company Awareness

From day one, Melissa says it’s important to create company awareness of cloud operations. FinOps teams should assign who is responsible for the cloud service, who is going to check the bill at the end of the month and who is going to learn and implement the strategies necessary to optimize costs and reduce cloud waste.

Anodot’s FinOps Solution

Anodot’s cloud cost management solution helps businesses understand cloud unit economics by aligning cloud costs to key business dimensions. This allows users to track and report on unit costs and get a clear picture of how infrastructures and economies are changing.

Anodot’s cost allocation feature helps organizations accurately map multicloud and Kubernetes spending data, assign shared costs equitably, and drive FinOps collaboration throughout your organization.

With Anodot, FinOps teams can easily classify and divide all of their cloud costs by business structures like apps, teams, and lines of business. Inform and empower business decisions at all levels from Anodot’s cloud cost management solution.

Start optimizing your cloud costs today!

Connect with one of our cloud cost management specialists to learn how Anodot can help your organization control costs, optimize resources and reduce cloud waste.